by Thomas | Mar 22, 2025 | eCommerce, Broker, Innovation, Podcast

Tom Ried, the host of The IBAC Teck Trek Podcast, interviews Thomas Accardo, founder and CEO of BrokerLift, discussing the functionality and benefits of the platform for Program Brokers, MGA/MGUs and Speciality Insurers. BrokerLift was the first plat...

by Thomas | Jan 2, 2022 | eCommerce, Uncategorised, Broker, Customer, Innovation, Insurance

Excited to share our recognition as an Insurance Business Canada Magazine 5 STAR Insurance Technology Provider for 2021. Nominated and voted on by Insurance Professionals across the country as one of the TOP 10 firms leading the industry into a more ...

by Thomas | Nov 12, 2021 | eCommerce, Broker, Customer, Innovation, Insurance, Customer-centricity, News

Proud to be selected to join the Guidewire Software Insurtech Vanguards program, a trailblazing new Guidewire initiative to help insurers learn about the hottest-new insurtechs — and how to leverage them. BrokerLift works with a number of leading Ins...

by Thomas | Dec 7, 2019 | Broker, Innovation, Insurance, Customer-centricity

While navigating the construction in NYC between meetings a few weeks back, I was hit with this Lemonade ad: “Insurance without 100 years of experience screwing you.” Being in the industry, my first thought was, that’s pretty bold, borderline insulti...

by Thomas | Feb 15, 2019 | eCommerce, Broker, Innovation, Podcast

Big thanks to Peter Tessier, the founder and host of The Insurance Podcast, for interviewing Thomas Accardo, BrokerLIft’s CEO. Peter and Thomas talk about change and innovation within the industry and dive into how retail theory should be a key part ...

by Thomas | Feb 11, 2018 | eCommerce, Broker, Podcast

Thanks to Nick Lamparelli for interviewing Thomas Accardo, CEO of BrokerLift. In Profiles of Risk episode 59 titled, “Disintermediate Yourself” Nick and Thomas talk about how the BrokerLift platform can help enable eCommerce and true online sales and...

by Thomas | Jun 21, 2017 | Broker, Customer, Customer-centricity, Relationships

Why do customer’s buy online? There may be many reasons; unique product or service, price, unavailable in the physical world or maybe because it’s just convenient. Ultimately, it’s that convenience, or service, that brings a customer to your Brokerag...

by Thomas | Apr 17, 2017 | eCommerce, Uncategorised, Broker, Insurance

We created BrokerLift to help independent insurance retailers do what they do best – to be solution providers, providing the right protection for any risk. As consumers, when we buy direct from a manufacturer we only get what that company makes, howe...

by Thomas | Feb 3, 2017 | Innovation, Insurance, News

According to Business Insider, Tesla will be launching a customized insurance plan for owners of its vehicles. The new program is underwritten by large global insurers and plans are in place to expand beyond their launch markets of Australian and Hon...

by Thomas | Jan 20, 2017 | eCommerce, Innovation, Insurance

Insightful article by Patrick Vice on InsBlog titled; “MGAs: on the Edge of Digital?” Our favourite quote “it’s the attitude not the tech, stupid.” We couldn’t agree more. When it comes to innovation one of the hardest parts is having the desire and ...

by Thomas | Dec 12, 2016 | Broker, Customer-centricity, Relationships

We were pleased to be asked to participate on one of the panel discussions at yesterday’s Insurance Institute’s 2016 Symposium West in Cambridge. Our panel, facilitated by Lissa Seguin from the Co-Operators, included Brenda Rose from FCA Insurance Br...

by Thomas | Nov 12, 2016 | Broker, Insurance, Customer-centricity

Adding eCommerce capability to your brokerage doesn’t need to take away from your primary value proposition; advice and guidance. When building online experiences we recommend replicating what you do everyday; ask customers questions, understand thei...

by Thomas | Oct 7, 2016 | Innovation, Insurance, Teamwork

We’re just going to put it out there right away, “at BrokerLift, we love underwriters.” Without forward thinking underwriters a customer-centric approach to eCommerce for Insurance products is impossible. The Internet customer, or self-directed custo...

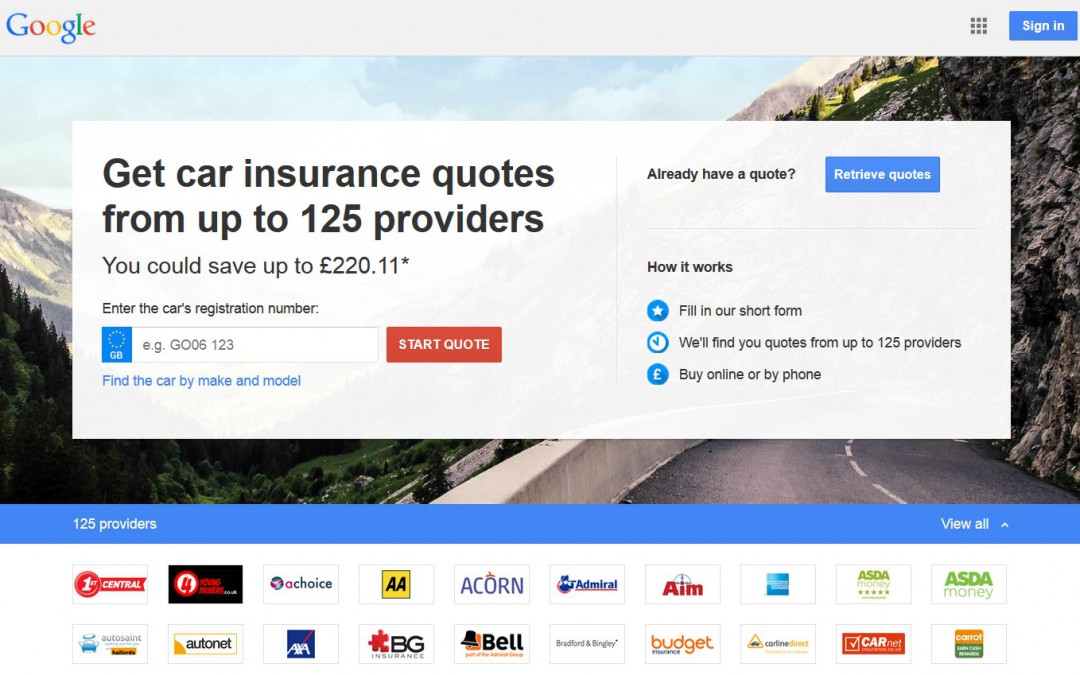

by Thomas | Sep 5, 2016 | Innovation, Insurance, News

What does Google know that we don’t know? Google Compare recently shut down; lots of reasons floating around as to why. Anyone who says Google couldn’t figure out car insurance – we’d have to politely disagree with them, there’s certainly no lack of ...

by Thomas | Aug 8, 2016 | eCommerce, Insurance, Customer-centricity

If you are a licensed and do things underwriters like and don’t do thinks underwriters don’t like then your insurance costs are easy to calculate. You can pay with your credit card to get those extra loyalty points, then check your email for your new...

by Thomas | Jul 12, 2016 | Customer-centricity

Came across this article on Forbes that highlights 6 key elements on how to appeal to Millenials. We talk a lot here at BrokerLift about designing service and product offerings aimed at target customer segments. The most underserved in the Insurance ...

by Thomas | Jun 2, 2016 | eCommerce, Customer-centricity

Turn Lack of Trust into an Opportunity Insurance companies and Brokers tend not to want to talk about Millenials; even as their average customer age continues to rise. In a typical conversation with an insurance professional you might hear: “Millenia...

by Thomas | May 16, 2016 | Innovation, Insurance, Customer-centricity, News

We get asked frequently what we think of Sonnet. As a website we like it. Contemporary, clean, user focused interface. Compelling copy that’s casual, approachable and easy to understand. We think the overall experience is very well done. What we like...

by Thomas | Feb 7, 2016 | Insurance, Customer-centricity

Too much of the same types of customers can lead to massive exposures in your business, it’s sort of like investing all your retirement savings on one stock or stepping up to the roulette table and putting in all on red. If a majority of your custome...

.png)

.png)